Company Structure

19/3/2022This is the second post in my business series, the first can be found here. In this post I will go through how my companies are structured.

A large part of being independent, as opposed to being employed, is the administration and navigation of a number of subjects that you are never exposed to as an employee, like accounting, bookkeeping, company taxes and insurance.

One of the first decisions you have to make is your company structure. Denmark has a few possibilities, which I will not get into now. You can read about them here. I have chosen to set up two “Private limited company” (“Anpartsselskab” in danish) type companies. One a holding company and one a production company, owned by the holding company. This is a flexible setup, which will shield me from losing personal assets if the production company gets sued into the ground, and allows me to create more companies or partnerships in the future easily, by spinning them out from the holding company. This comes at the cost of more administration time and expenses, than a sole-proprietorship company would have.

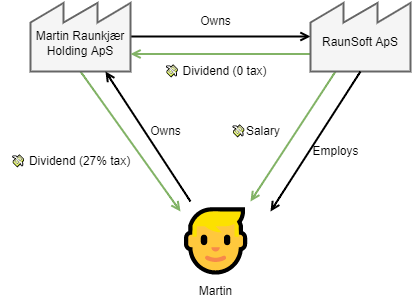

The diagram above describes the ownership relationship, as well as the moneyflow, of my company setup. I, private person Martin, owns the holding company (Martin Raunkjær Holding ApS), which owns the production company (RaunSoft ApS), which employs me. As for the moneyflow, RaunSoft ApS will earn money through software consulting, contracting and freelancing. Firstly, this money will be used to pay for expenses, such as equipment, administrative costs, insurance, commision and accounting. Then comes salary payments to myself, which will be up to the top tax limit (topskattegrænsen), which is about 50.000 dkk monthly at the time of writing. After this, probably, some amount will go to pension, which I haven’t looked into yet. After this, the remaining capital will be paid as dividends to the holding company. This will be at 0% tax, because the holding company owns at least 10% of the production company (in this case 100%). However, before this 22% tax will be paid in company tax (selskabsskat). From the money that makes it to the holding company, 60.000 dkk a year will be paid out as dividends to myself at a 27% tax rate (after 60.000 would result in a 42% tax rate). The remaining capital in the holding company will then be invested in mutual funds / ETFs, to be paid out in dividends at a later date or used to spin out more companies. Dividends can only be paid once a year (or during “special” circumstances) but money can freely be “lent” between the companies at market rates, so it is possible to invest the earnings from the production company via the holding company each month (although they are not “safe” from lawsuits before being paid as dividends).

This is the basic structure. It is a little light on actual numbers, as I don’t know how much the expense payments will be and how much money will come in. Later, I might make an example with actual amounts from my first or second year. Cheers!